Federal bank housing loan interest rates 2023

Ad Compare More Than 275000 Deposit Rates From Over 11000 Banks Credit Unions for Free. The final interest rates offered to the home loan applicants depend upon.

Here S The Income Portfolio You Want To Own When Interest Rates Rise Portfolio Interest Rates Option Strategies

Trusted VA Loan Lender of 300000 Veterans Nationwide.

. Compare 2022s Best Home Equity Lines of Credit. Payment doesnt include taxes or insurances. Old rate 2021-2022 528.

Upto 85 of the project cost. Reviews Trusted by 45000000. In March the Fed affirmed its plan to.

Federal Bank Home Loan Interest Rates. We Offer Competitive RatesFees Online Conveniences - Start Today. Interest Rate applies to a 150000 loan.

Bank Has Loan Officers To Personally Guide You Through the Home Mortgage Process. The rate of interest on different home loan schemes offered by Federal Bank varies from one customer to. Lock Your Rate Now With Quicken Loans.

For the average owner-occupier loan this would mean an interest rate. The interest rates for Federal Bank home loans start at 905 pa. 875 to 92.

119 to 1515. Federal Bank Home Loan Interest Rates The interest rates for Federal Bank home loans start at 905 pa. Contact a Loan Specialist to Get a Personalized Quote.

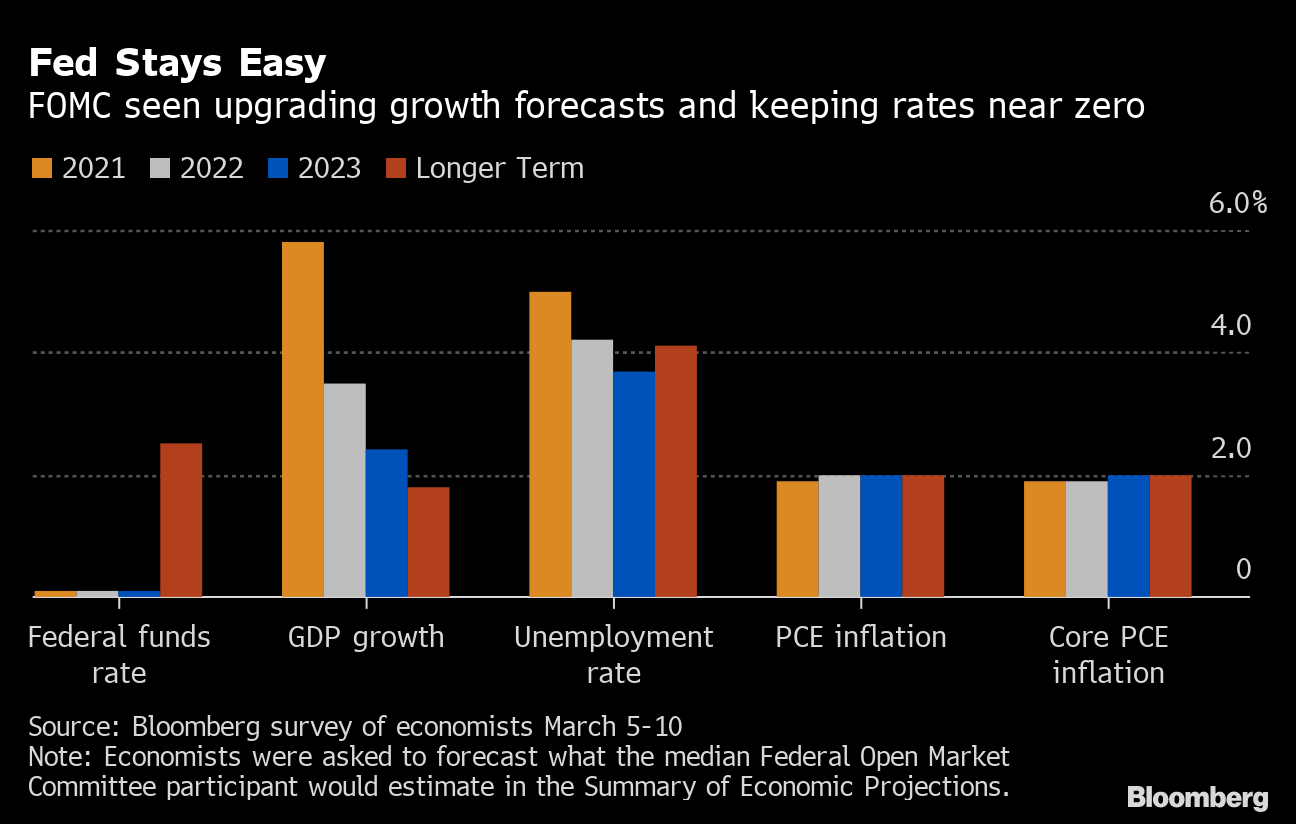

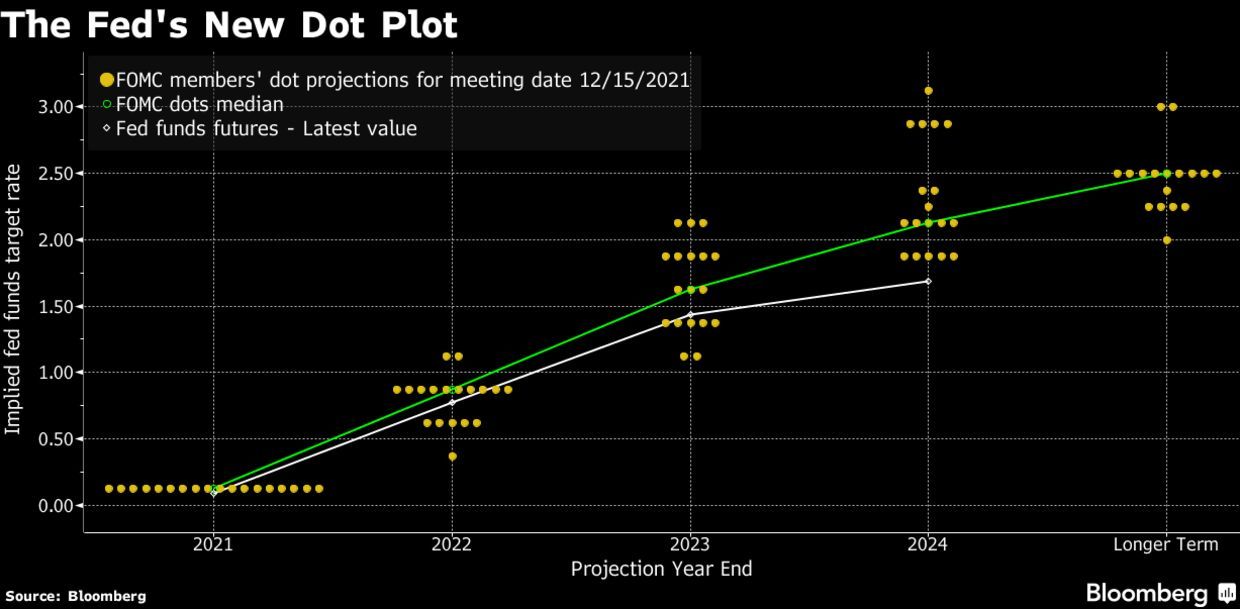

They see the Feds key rate peaking at a range of 35-375 in the. Ad Were Americas 1 Online Lender. The Federal Reserve has kept interest rates near zero to help spur an economic recovery in the wake of the pandemic.

4 rows New rate 2022-2023. Bank Has Loan Officers To Personally Guide You Through the Home Mortgage Process. Not everyone qualifies for these loans based on financial need.

Federal Bank Home Loan Interest Rates. Grow Your Savings with the Most Competitive Rate. Interest rates for Resident Term Deposits effective from 17-08-2022.

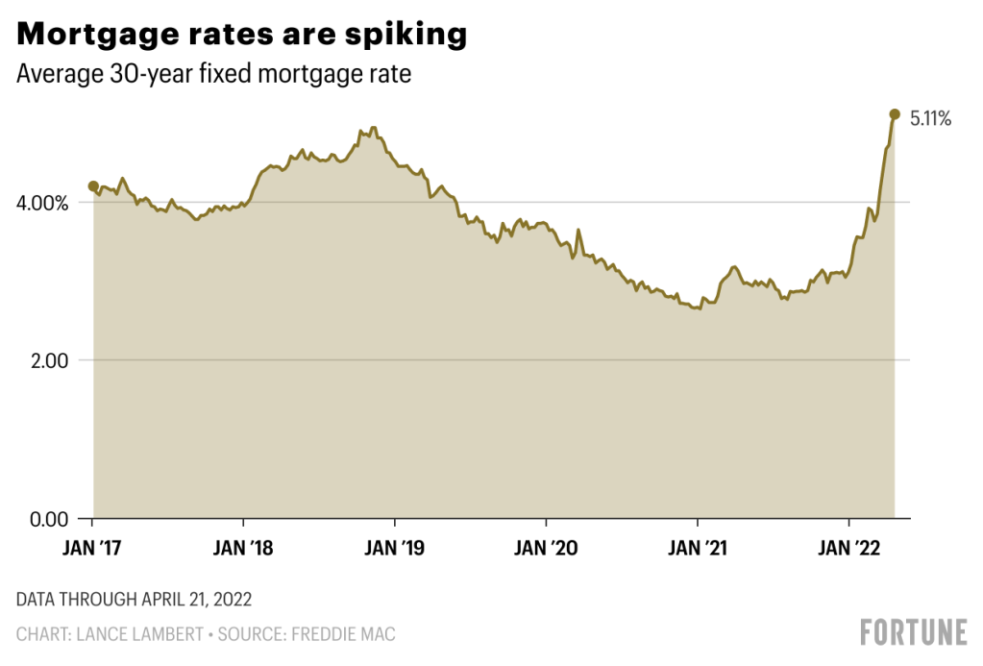

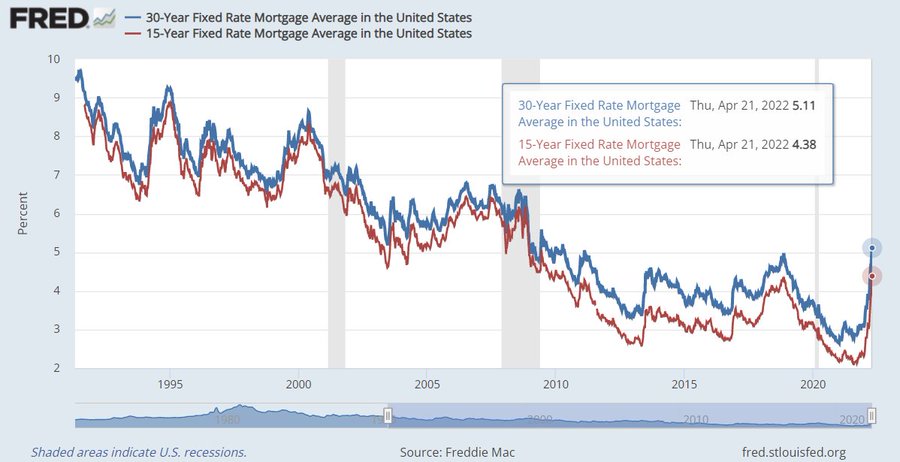

It was set up in 1916 by M. The final interest rates offered to Federal Bank home loan. It means variable home loan interest rates could rise by anywhere from 2-3 over the next couple of years.

Compare Open an Account Online Today. We Offer Competitive RatesFees Online Conveniences - Start Today. This years interest rates are.

New rate 2022-2023. The federal government pays the interest for students enrolled half time or more. Apply Online For A Home Loan.

New rate 2022-2023 654. Available to Graduate and professional students All students are eligible regardless of financial need. KVG Bank Housing Loan Interest Rate Karur Vysya Bank KVG is an Indian private-sector bank headquartered in Karur in Tamil Nadu.

Heres what to know. Single Deposit Less than 200 Lakhs -. One Year MCLR 315.

This potential halt in growth is why Berenberg economists expect the Fed to start cutting rates late next year. Buy Or Refinance A Home. Federal Bank Housing loan interest rates starts from 805 pa.

Housing loan interest rates will change subject to the changes made by BankRBI from time to time. Rate based on Credit Score of 740 or above. 4 rows Youd end up paying a total of 698363 in interest in 10 years if you borrowed for the 2021-2022.

Get Your VA Loan. Students Subsidized and Unsubsidized 499. Single Deposit Less than 200 Lakhs - General Public.

Maximum - INR 15 Cr.

Fed To Hike Rates In 2023 But Dots Won T Show It Economists Say Bloomberg

Mortgage Rate Predictions For 2023 Propertyonion

Pin On Numerology April 2021

Mba Lowers Mortgage Outlook Through 2023 Credit Union Times

Gear Up For The 2022 And 2023 Housing Correction 5 Charts Highlighting The Pain Ahead For The Housing Market Dr Housing Bubble Blog

What Home Prices Will Look Like In 2023 According To Zillow S Revised Downward Forecast

Federal Reserve Hikes But Will It Cut In 2023 Morningstar

Economists Say Fed Could Shrink Balance Sheet In 2023 Critics Insist Central Bank In 2022 Cyber Security Economic Environment Blockchain

Fannie Mae Predicts Eight Rate Changes Before 2024 Themreport Com

Fed Raises Rates And Projects Six More Increases In 2022 The New York Times

4 5 Mortgage Rates In 2023 That S The Latest Estimate From Fannie Mae The Truth About Mortgage

Can House Prices Fall In 2023 According To Expert Forecasts As Usa

Mortgage Forecasts Now Pulled Back Through 2023 Credit Union Times

Fed Seen Speeding Taper Of Mbs In Early 2022 Start To Pullback Economist Surveys Federal Reserve

Where Home Prices Are Headed Through 2023 As Forecast By Bank Of America R Wallstreetbets

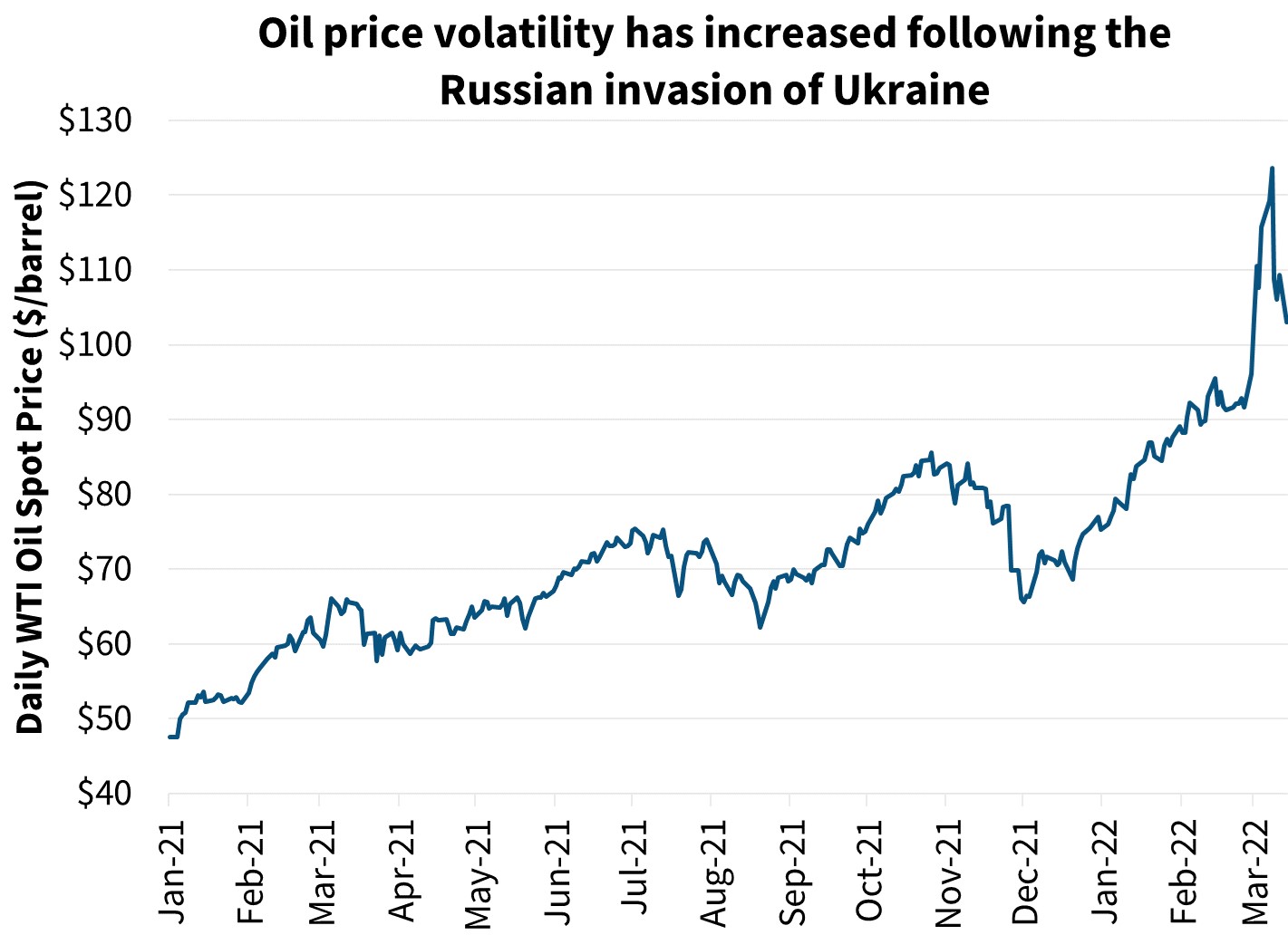

A Us Recession In 2023 Is Expected By A Lot Of Investors World Economic Forum

Fed Leaders Predict 3 Interest Rate Hikes In 2022 2023